All-In-One Fraud Solution.

Ready to comply with PS23/4, PSD3 and emerging regulations.

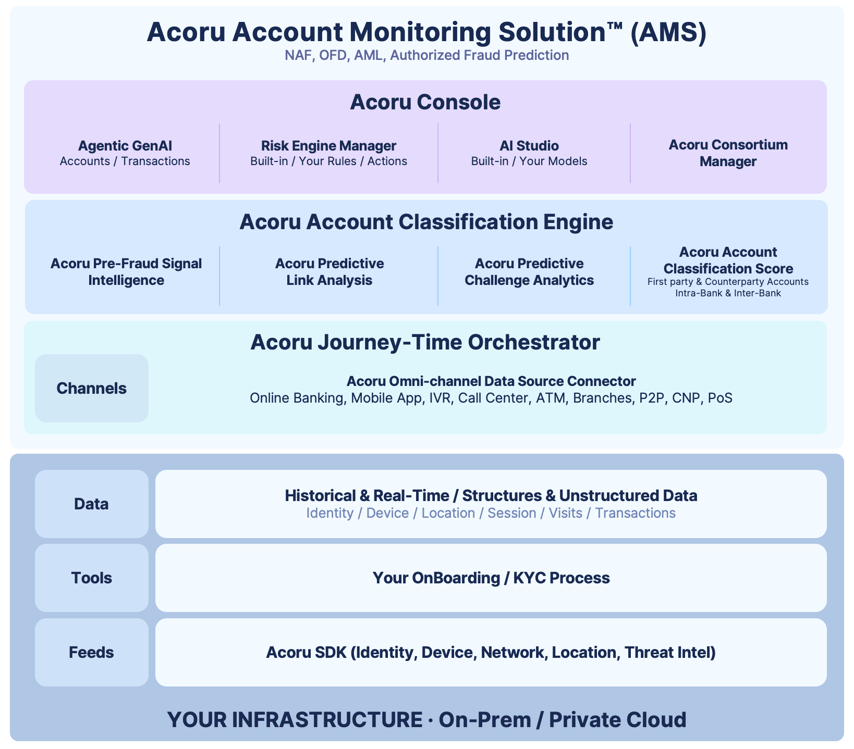

The Acoru Account Monitoring Solution™ (AMS)

stops Authorized Push Payment (APP) Fraud

& ensures compliance with the latest Banking Regulations

Pro-actively and selectively block fraudulent transactions in victim, unwitting & witting money mule accounts

Freeze complicit mule & money laundering criminal accounts, before money is moved

Meet all your Fraud Prevention needs with New Account Fraud (NAF) Detection, Online Fraud Detection (OFD), Transaction Monitoring (TM) and Scam Detection.

AND Comply with IPR, PSD3, PSR and emerging Banking Regulations

Money Mule Monitoring

Fraud and AML regulatory bodies worldwide (PSR, EBA, FINCEN, AMLA) are putting financial liability pressures that encourage identification, reporting, and monitoring of money mules.

Acoru Account Classification Engine

Continuously scores first-party & counterparty accounts,

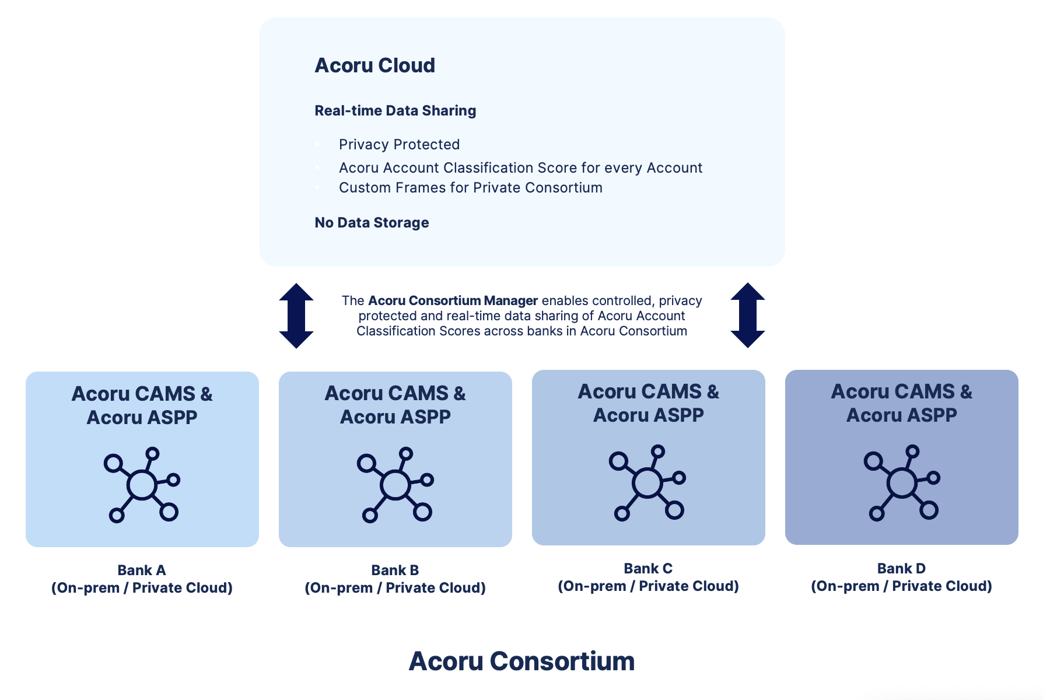

across the customer journey, channels & Acoru Consortium banks,

before money is moved

Acoru Pre-Fraud Signal Intelligence proactively detects hidden traces left by fraudsters during the preparation phase (before any fraud is committed) enabling early intervention in both authorized and unauthorized fraud detection

Acoru Predictive Link Analysis reveals connections between first-party & counter-party accounts as money is both sent and received.

An Acoru Account Classification Score is generated continuously for every first-party and counter-party account within the bank and across Acoru Consortium banks.

Acoru Authentication Challenge Analysis examines transaction approvals, vulnerable challenges, and deceptive responses to recommend strong, context-sensitive challenges in real-time, before a transaction is approved and money is moved.

Acoru Account Monitoring Solution™ (AMS)

Simple & Complete - Use your existing Identity, Device, Intelligence, Location, and Threat Intelligence feeds or integrate with the Acoru SDK for a complete All-In-One Solution with New Account Fraud (NAF) Detection, Online Fraud Detection (OFD), and Transaction Monitoring (TM).

Acoru Agentic GenAI is easy to use. No learning curve for beginners, no limits for pros.

Acoru Omni-Channel Data Source Connectors do the heavy lifting of data transformation and integration so you don’t have to.

No Rip & Replace - Acoru fits into your existing infrastructure and fraud tech stack.

Retain full control of your data and sharing with Acoru Consortium Banks.

Learn More

3 min read

Where Multichannel Falls Short, Omnichannel Stops the Bleed

Regulatory Framework

How to Prepare for and Comply with New Financial Regulations in Central America and Mexico.