Pro-actively and selectively block fraudulent transactions in victim & unwitting mule accounts

Predict Authorized Push Payment (APP) Fraud.

Enhance your Transaction Monitor with the latest insights & Account Reputation Scores in compliance with PSD3.

AI-native, Open platform keeps up with emerging Gen-AI fueled scams.

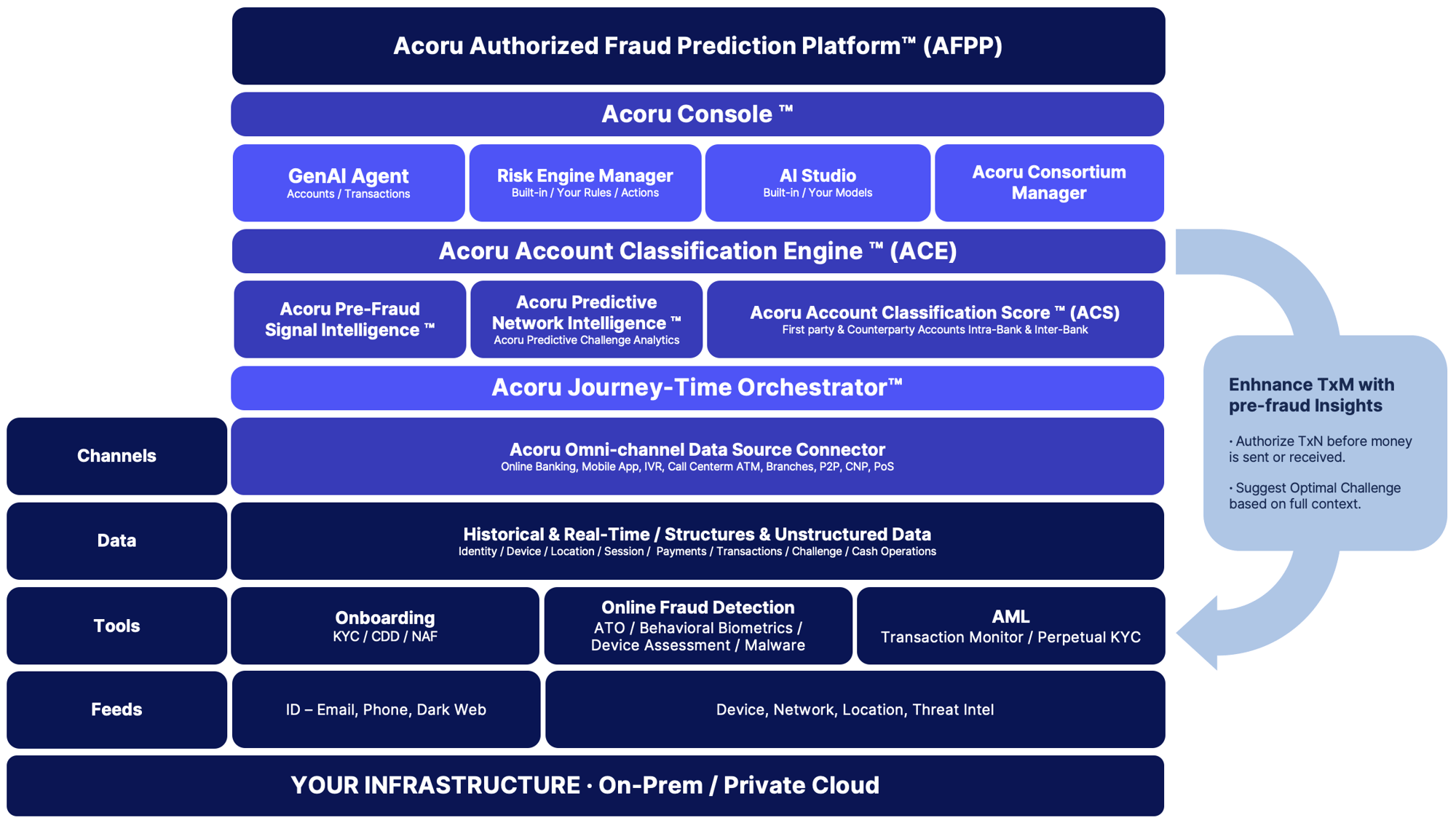

Acoru Authorized Fraud Prediction Platform™ (AFPP)

Stops Authorized Scams, before money is moved.

Freeze complicit mule & money laundering criminal accounts, before they can be used for scams

Comply with IPR, PSD3 & PSR

Instant Payments Regulation (IPR) requires banks to reimburse victims of Authorized Push Payment (APP) scams and share the cost of reimbursement 50:50 between sending and receiving banks.

Payment Services Directive 3 (PSD3) mandates banks to enhance fraud detection by implementing IBAN-name checking, enforce stricter controls on high-value transactions, and issue mandatory consumer warnings before payment execution.

Payment Services Regulation (PSR) requires banks to comply with mandatory APP fraud reimbursement policies (PS23/4), deadlines, and preventive technologies.

Acoru Account Classification Engine™ (ACE)

Next-Gen & AI-Native

Continuously scores first-party & counter-party accounts, across the customer journey, channels, and the Acoru Consortium, to predict fraud, before transactions are approved.

Acoru Pre-Fraud Signal Intelligence™ monitors omni-channel activity including unauthorized and authorized fraud intent

Acoru Pre-Fraud Signal Intelligence™ analyses alerts across the customer journey to filter out false positives and false negatives

Acoru Predictive Network Intelligence™ connects all accounts, inter-bank and intra-bank

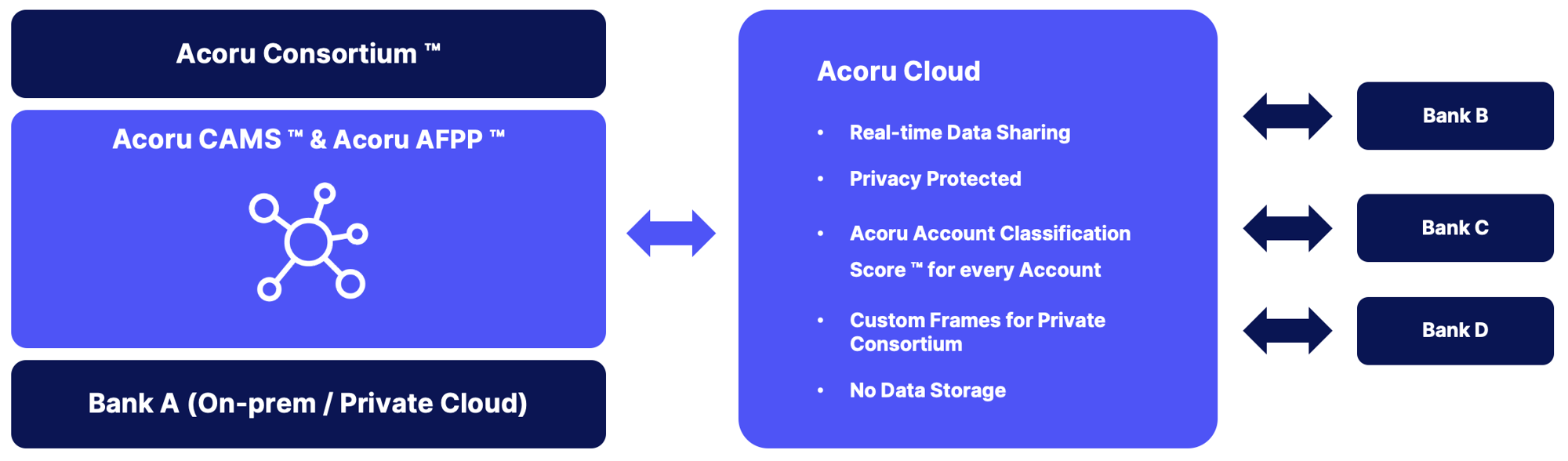

Acoru Consortium™ banks exchange a Acoru Account Classification Score™ - for every first-party and counterparty account

Acoru Predictive Challenge Analytics™ examines transaction approvals, vulnerable challenges, and deceptive responses to recommend strong, context-sensitive challenges in real-time, before a transaction is approved and money is moved.

Acoru Authorized Fraud Prediction Platform™ (AFPP)

NextGen & AI-Native

´The NextGen Acoru Platform is open, giving you full control to customize and stay ahead of the latest AI-armed scams.

The AI-native Acoru Platform is transparent, with clear explainability, in compliance with regulations that require fair and unbiased decision-making.

Acoru GenAI Agent™ is easy to use. Analysts need no training and no coding eliminates the risk of coding errors

Acoru Omni-Channel Data Source Connectors™ do the heavy lifting of Journey-Time Orchestration so you don’t have to

Acoru Pre-Fraud Signal Intelligence™ filters out false positives / false negatives and frees your analysts for more important work

Acoru fits into your existing infrastructure on-prem or in your cloud. There is no Rip & Replace needed, the data stays in your environment, and you control all privacy-protected and real-time data exchange with Acoru Consortium™ Banks.

Learn More

7 min read

"Urgent Request from the CEO": Don't fall for the CEO Scam

3 min read

Where Multichannel Falls Short, Omnichannel Stops the Bleed

Regulatory Framework

How to Prepare for and Comply with New Financial Regulations in Central America and Mexico.